Trade receivables are easy to calculate – they’re simply the total of all currently outstanding invoices sent to customers or clients. Accounts payable is the opposite of accounts receivable or trade receivables. Accounts payable refers to the amount of money a business owes to its suppliers for goods or services delivered.

Accounts Receivable (AR) Discounted: What it Means, How it Works – Investopedia

Accounts Receivable (AR) Discounted: What it Means, How it Works.

Posted: Sun, 26 Mar 2017 03:40:43 GMT [source]

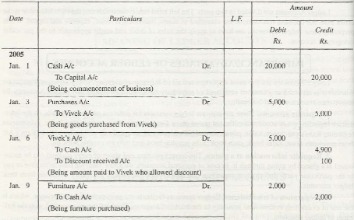

When companies sell items on credit, they record the amounts owed to them as trade receivables. Management, knowing that some receivables will go uncollected, records allowances. Allowances serve to lower the carrying value of receivables to the amount management reasonably expects to collect. Net trade receivables are calculated by subtracting sales discounts, returns, allowances, and collections from total credit sales for the period. Finally, trade receivables may be transferred, or shifted, to another entity in exchange for cash. An increase in the trade receivables amount may mean a company has sold extra product during a certain period, or that they are not getting payments for invoices in fast enough.

Tips to Reduce Your Cash Conversion Cycle

Accounts payable is a liability account on the balance sheet, while accounts receivable is an asset. The amounts for accounts receivables are recorded in the balance sheets because there is a legal obligation from the client to pay the debt to the company. This is a current asset meaning the account needs to be settled in less than a year.

- A customer is extended a short credit line that needs to be settled in a few days or a couple of months.

- Trade receivables as a standalone metric don’t tell much about a business’s financial position.

- Accounts receivable are an important aspect of a business’s fundamental analysis.

- In these situations, the firm can obtain a short-term loan from a lender that uses the outstanding receivables as collateral.

- Trade receivables are amounts billed by a business to its customers when it delivers goods or services to them in the ordinary course of business.

Discounts on early payments can motivate many to repay and late payment fees may deter them from further delay. This requires companies to write off this amount from assets and then expense it to reflect an incidence of loss in the company’s books. This is any other receivable that the company has that does not fall under the day-to-day operations or selling of the business.

Trade Receivables definition

It only affects the income statement when those asset items are writ off or written down. Since this is a confirmed sale, it is recognized as revenue per revenue recognition principles. Therefore, trade receivables can simply be defined as the amount that needs to be collected from the accounts receivables. Trade receivables are called so because they arise from business trade deals between the company and a customer.

Trade receivables is a term used to describe the money owed by one company to another. In this article, we will discuss what trade receivables are, how important they are for business owners, and what you can do to reduce your company’s trade receivables. Debtors are people or entities to whom goods have been sold or services have been provided on credit and payment is yet to be received for that. When a company sells goods on account, customers do not sign formal, written promises to pay, but they agree to abide by the company’s customary credit terms. However, customers may sign a sales invoice to acknowledge purchase of goods.

Allows Easy Tracking of Customer Credit

For example, dentists might offer installment payments to patients for procedures not adequately covered by their insurance companies. It has an important role to play in determining its revenue and profitability. They are assets for the organisation and thus allows seeking loans against the bills the customers owe.

Allowance for Doubtful Accounts: Methods of Accounting for – Investopedia

Allowance for Doubtful Accounts: Methods of Accounting for.

Posted: Tue, 29 Aug 2023 07:00:00 GMT [source]

However, it must be duly noted that only those transactions are supposed to be recorded as other receivables that are certain to be received. Transactions that are contingent or are unlikely to happen should be included in other receivables. The accounts receivable balance is presented on the balance sheet after deducting any Allowance for doubtful accounts. In general, receivables should be recorded at the present value of the future cash flows, using a realistic interest rate. We found that the trade receivables for Company XYZ is $185,000, and they have annual revenue of $750,000. Similar to factoring is invoice discounting, in which an invoice discounter advances a percentage of the value of an invoice.

Sometimes, companies are not able to pay the money they owe for a very long time, or ever. The company may have gone out of business, maybe their industry is seeing a downturn in demand, or it simply does not have the cash flow. There is an allowance for this on the vendor’s balance sheet with a line amount called “Allowance For Doubtful Accounts”. Companies can calculate the amount a number of ways, but the amount is deducted from the accounts receivable total in the assets section of the balance sheet. However, they include any amounts owed from parties that do not meet the requirements to be classified as accounts receivable.

Our Team Will Connect You With a Vetted, Trusted Professional

This promise to pay by the customer is an account receivable to the seller. Accounts receivable are amounts that customers owe a company for goods sold and services rendered on account. Trade receivables is the amount that customers owe to a business when buying a product or service on credit.

This allows companies to closely monitor their sales and expenses and helps them to stay on top of their cash flow processes. By monitoring these numbers, companies can ensure they are only extending credit to customers who are likely to pay on time. This helps companies maintain their cash flow and minimize their risk of bad debt.

ABL can also be structured around other assets, such as commercial property, equipment, or inventory. If you’re not clear on when your company wishes to get paid, then clients can and will take their time paying you. Overall, Volopay is an ideal solution for businesses looking to streamline their business accounting processes. It provides an intuitive platform with powerful features that can help businesses to save time, money, and resources. As mentioned above, it includes small amounts aggregated into a single heading.

Non-payment data allows businesses to make timely collections and come up with repayment plans. This information is also critical if the company needs to go non operating income example, formula the legal way. No, trad and other receivables are balance sheet items classified as current assets and are not recorded or reported in the income statement.

Definition of Receivables

Once the customer has paid the bill, the company will credit the trade receivables account by $475 and debit the cash account. Nontrade receivables are also classified as current assets; however, they can be moved into noncurrent assets if payment is expected to take more than a year. Often a company will follow up on an outstanding invoice, only to be told payment is coming and it never arrives.

On the contrary, a high DSO means poor cash flow and low working capital. Comparing it with the industry average DSO can help conclude if the business has a good cash flow or not. Early payment programs can provide considerable flexibility when choosing which invoices to finance. This type of solution also gives sellers more certainty about the timings of future payments, making it easier to forecast cash flows effectively. Another option is asset-based lending (ABL), in which companies can access a line of credit with funding secured against assets such as accounts receivable.

AI-Based Deduction Management Software

Any amount of money owed by customers for purchases made on credit is AR. Most importantly, they play a significant role in ensuring that your business has a healthy cash flow. With a culture of late payments now prevalent across many industries across the US, small businesses are often the ones to suffer. Indeed, research from GoCardless indicates that 2 in 5 SME businesses have serious cash flow problems that are caused by late payments. By ensuring that trade receivables are collected in a timely fashion, you can make sure that your company’s cash flow remains healthy.

It is the total amount receivable to a business for sale of goods or services provided as a part of their business operations. Electricity companies bill their clients after the clients have utilized the electricity. The company will make records of the account receivable, all the unpaid invoices that the client needs to pay.